What’s it for:

Tax codes are used to indicate taxes to be charged on parts and services in reports.

How to access the Tax Codes subgrid:

The Tax Codes grid is accessed from the SubGrids menu bar in the main navigation pane menu bar

Where selected and used:

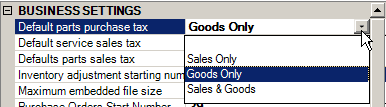

•defaults set for Default parts purchase tax, Default service sales tax and Default parts sales tax in GlobalSettings

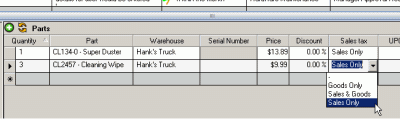

•selected within a service workorder's Labor, Travel, Miscellaneous Expenses, and Loans

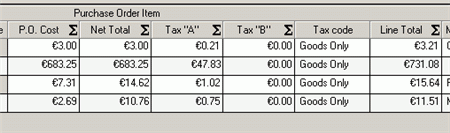

•selected within Purchase Order Items

•The actual tax values based on the Tax Code selected displays as columns in the Labor, Travel, Miscellaneous Expenses, and Loans grids

•Taxes are available in detailed reports from Purchase Orders, Service Workorders, and from summary reports from the Service navigation pane sub grids such as Parts, Labor, Travel, etc

Creating, editing and deleting:

•Once a tax code has been entered and the Tax Codes grid closed (which automatically saves) the tax code itself can not be deleted, and the tax code %'s can not be edited.

•You can edit the name of the tax code at any time

•You can set the tax code to inactive (uncheck the Active checkbox) so that the tax code can not be selected in the future

•You can not edit the %'s of a saved tax code

•You can not delete a saved tax code

Setting a tax code to inactive:

•You must first make sure that the tax code is not selected as a default in your Global Settings.

•AyaNova has three sample tax codes pre-entered that are not deleted when you erase the sample data. If you will not use these percentages then create your own tax codes percentages, set defaults in Global Settings, and then return to the Tax Code grid to set the tax codes to inactive that you will not use.

•You can create as many different tax codes as you need.

•You can set a default tax code for purchases of parts, for sale of parts, and for labor service charges via the Global Settings under Administration. Setting a default for these means less selection when purchasing parts or selling – but still allows you to select specific when needed.

•Use of Tax Codes is optional in AyaNova, as you can certainly just create a tax code that has 0% and set as your defaults in Global Settings, and remove taxes from showing in any report templates.

Refer to How to add/edit/delete/make inactive records in a subgrid

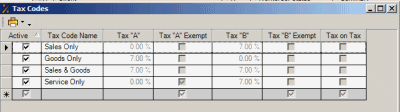

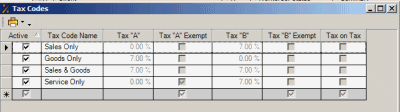

The columns of the Tax Code grid:

Active column

This is a checkbox field where you indicate whether the Tax Code is active or not. A checkmark indicates an active tax code and will have this tax code display in drop down selection lists. An inactive is not checked, and will not display in drop down selection lists.

Tax Code Name column

This is a text field where you indicate the name of the Tax Code that will display in drop down selection lists in Purchase Orders, a workorder item sub-screen Parts, a workorder item sub-screen Labor, and a workorder item sub-screen Travel.

Tax “A” column

Enter the tax using decimals. When you tab or click out of the field it will display in %. For example, enter in .07 and tab out. The field will automatically convert to display as 7.00%

Tax “A” Exempt column

If checkmark within the Tax “A” Exempt column, that will cause that Tax “A” to revert to 0%

Tax “B” column

Enter the tax using decimals. When you tab or click out of the field it will display in %. For example, enter in .07 and tab out. The field will automatically convert to display as 7.00%

Tax “B” Exempt column

If checkmark within the Tax “B” Exempt column, that will cause that Tax “B” to revert to 0%

Tax on Tax column

Tax On Tax indicates that where in AyaNova taxes are calculated, Tax B is applied to the total of the item plus the Tax A.

For example, if you had a tax code that was 5% for Tax A and 6% for Tax B, and the product the tax was applied to was priced at $10.00, - Tax A would be $0.50 ($10.00 * 5%) and Tax B would be $0.63 (($10.00 + $0.50 Tax A) * 6% Tax B)

Security Group internal object: Object.TaxCode |

Forbidden: User of that security group can not access the Tax Codes subgrid at all |